Even though things are looking up in Australia at the moment, it’s expected that consumer confidence is going to take a bit of a hit early next year when the COVID-19 government subsidies are set to end.

In tough economic times like these, all too often businesses focus their attention – and marketing dollars – on acquiring new customers to generate much-needed revenue. Meanwhile, they overlook the huge potential hidden in their customer base.

Understanding the worth of increased customer loyalty

Prior to the recession, managing a business to increase customer loyalty has always been recognised for its lucrative upsides. Creating loyal customers improves customer retention which improves bottom line. In fact, retaining customers can cost businesses five times less than acquiring new ones. And the success rate of selling to an existing customer is 60-70%, compared to just 5-20% for a new one.

And in case you need a few more reasons:

- Less acquisition marketing – no need to get out there and convince new businesses or people to purchase from you.

- Higher profits – existing customers already trust you. They are less focused on price and more open to up-selling and cross-selling opportunities.

- Lower costs – attracting new customers costs more than keeping an existing customer on board and happy.

- Learn from your customers – it’s a great opportunity to listen to customer feedback and improve your offering and customer satisfaction.

In short, it pays to look after existing customers. So, what are the strategies and tactics needed to grow your revenue through existing customers? In this blog, we share ways to help you earn customer loyalty, and keep it.

First, with buying behaviours and sales cycles differing across B2B and B2C, you’ll want to tailor a customer loyalty strategy to your business model:

Business to Consumer

B2C businesses sell their products or services to people like you and me, and rely on making money by selling to many thousands or millions of customers annually.

- Buyers tend to make more impulsive purchase decisions

- Purchases are low cost and low risk

- Lower customer acquisition costs

Business to Business

B2B businesses sell their products or services to each other. Because each sale is worth more, they don’t need as many customers.

- Buying decisions are carefully considered

- Sales cycles are long and involve more people

- Higher customer acquisition costs

- Purchases are high risk, the decision can jeopardise the entire business

- Buyers require in-depth information and develop closer relationships with the sales team

- Loyalty has the potential to last longer

Let’s now turn our attention to the ways B2C and B2B businesses increase customer loyalty and use upsell and cross-sell opportunities to generate profits.

The foundation: A customer first culture

Businesses don’t sell to businesses. They sell to people. And nothing beats the human touch. It makes sense then to assemble the most customer-centric, account management team possible. Or if you are a smaller team, provide training and guidance to drive a customer-focused culture. No one vanishes after the deal is closed. Instead, your people cultivate the skills to listen to the customer and be ready to solve their problems. By being an indispensable partner, you will gain intimate knowledge of your customer’s business and their needs, making it easier to identify opportunities for upselling a new product or service. Get it right and every conversation will help you develop a closer relationship with your regular customers, and drive repeat purchases.

Personalise customer loyalty and rewards programs

More commonly associated with B2C businesses, there are just as many business benefits for rewarding B2B customers with personalised loyalty programs.

A good starting point is to determine the actions you would like to reward – referrals or purchases, for example. You can then decide on the type of reward, perhaps a monetary incentive, a product add-on or the opportunity to be involved in programs exclusive to existing customers. Not only will this build long-term relationships that are so central to sales, it will ensure existing customers look forward to every new business interaction with your company.

Build relationships through educational events and training

It may seem obvious, but providing helpful information to your customers will encourage loyalty. Customer education and training can take many forms including webinars and seminars and conferences. These types of events are mutually beneficial – you showcase and explain the benefits of your product or services while gathering direct feedback to improve your offerings. Meanwhile, the customer has the opportunity to broaden their knowledge and understanding of your products, services and industry at large. Take it a step further and invite existing customers to take part in panels and share their insights.

Customers who are more educated about your product will better understand its value for their business, increasing the chance of staying with you long-term and purchasing additional products or services.

Visibility to identify upsell and cross sell opportunities

Having the ability to better anticipate and meet the fundamental needs of your customers, will not only help you earn their loyalty, but also uncover new revenue opportunities. The problem is that a lack of available data or the set up to synthesise it, and organisational silos are preventing many companies from understanding their customers’ needs and interacting in a way that reflects a customer’s unique context.

But how do you get this kind of visibility? Modern cloud finance systems play a critical role here. Once the sole domain of large enterprises, cloud business ERP systems have been emerging as a viable and affordable option for SMBs. Primarily known for their ability to optimise and streamline operations, they also provide a single, unified view of the customer by bringing together once-siloed data from a variety of business systems and channels – POS systems, marketing platforms, warehouses, websites, customer service and call centres.

For example, an integrated ERP and commerce solution allows on-the-ground sales consultants to access user records that detail a customer’s purchase history and loyalty level. Armed with contextual information, they are empowered to share relevant offers and promotions with the shopper, increasing the likelihood of purchasing.

Personalised targeting can also be achieved at scale. Cloud solutions provide an omnichannel customer view that connects multiple customer touchpoints over different channels and periods of time, enabling businesses to better understand the customer journey and orchestrate personalised upsell or cross-sell actions. Of course, only if it is relevant to the customer and will fulfill their goal. These systems also provide the level of robust analytics and reporting needed to model customer value, make profitable cross-sell and upsell decisions and report on the impact of any upsell initiatives.

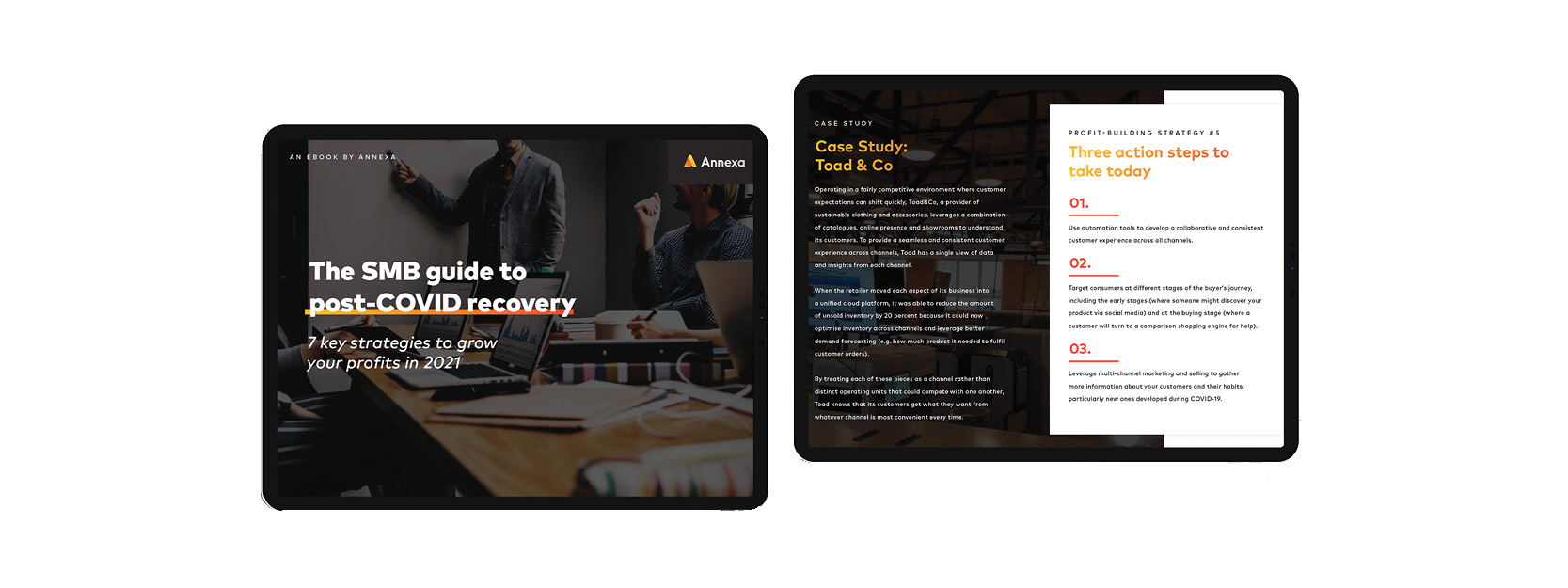

Want to grow your profits in 2021?

Download our SMB guide to post-COVID recovery!

Annexa is a leading NetSuite partner with extensive experience designing and implementing comprehensive and customised business systems, including payroll solutions, financial management, warehouse management and ecommerce solutions.