Webinar Recap: Digital transformation for skyrocketing financial efficiency

with CPA Australia & Annexa

Speakers

- Host: Kyelie Baxter FCPA, CPA Australia Councillor & Director, IQ Accountants

- Hoss Taher, Senior Project Manager, Annexa

- Jarred Spriggs, Director, Annexa

Webinar in a nutshell

This November, in collaboration with CPA Australia, we hosted a webinar centred on the financial tools essential for boosting financial efficiency. If you’re a finance leader keen on driving technology transformation, this is a must-watch. Access the full webinar here, or for a comprehensive breakdown of the topic, scroll down.

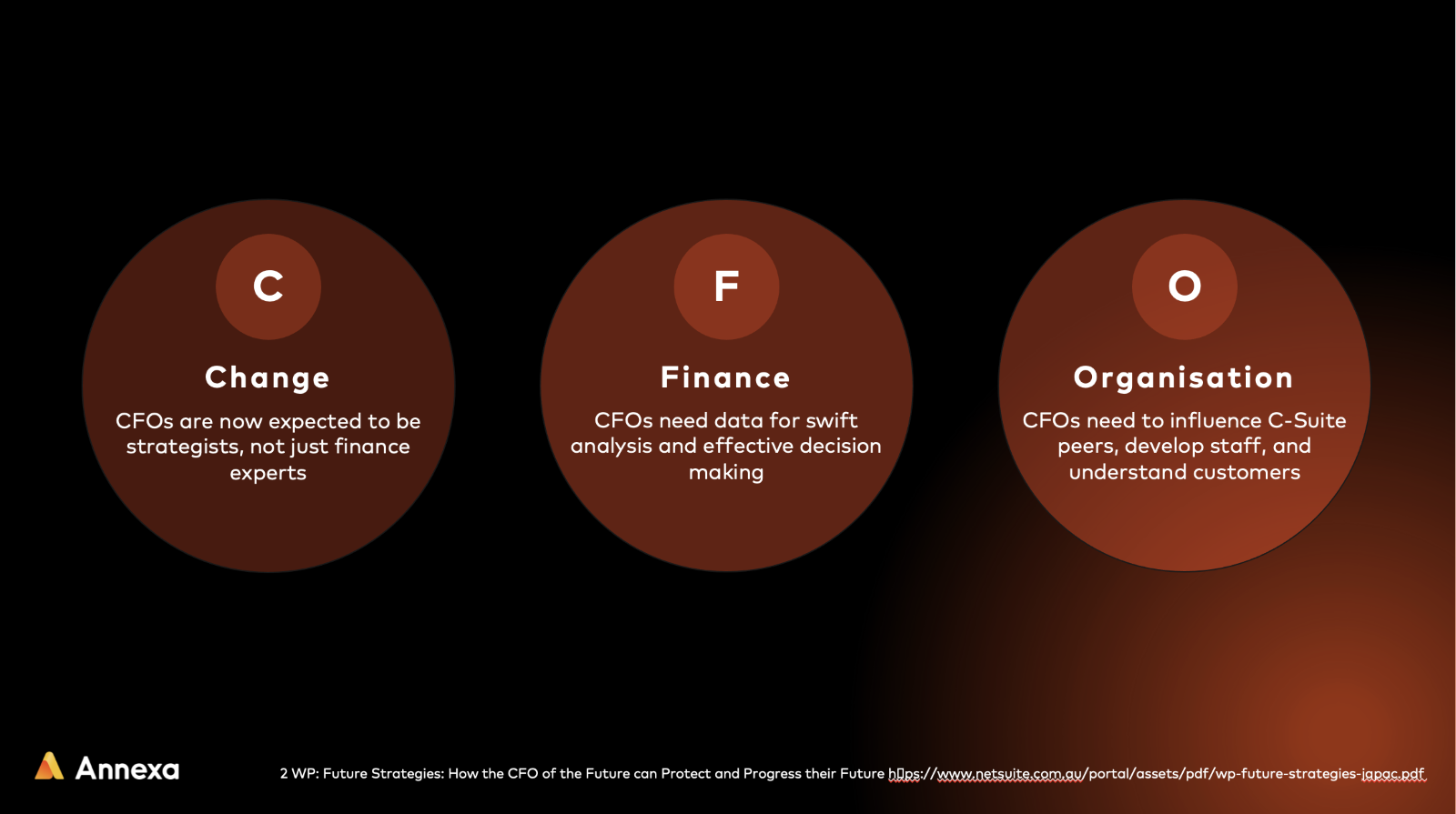

The role finance leaders play in tech transformation

As finance leaders shift from conventional finance-focused roles – such as budgeting, accounting, and risk management – to more strategic, technology-driven positions, they are increasingly becoming central players in an organisation’s digital transformation initiatives.

Strategic decision-making | Expertise in financial management when combined with an understanding of digital technologies, positions finance leaders uniquely to guide strategic decisions that align financial goals with technological advancements.

Datafication | The concept of ‘datafication’ – transforming business processes into data-driven operations – means finance leaders must understand and leverage the vast amounts of data generated by digital technologies to inform, risk assessment, and discover new opportunities.

Influencers of technology adoption | Technology is no longer just supporting the finance function rather it has become a strategic tool. Which makes finance leaders instrumental in identifying and implementing technology solutions that enhance financial efficiency and overall organisational success.

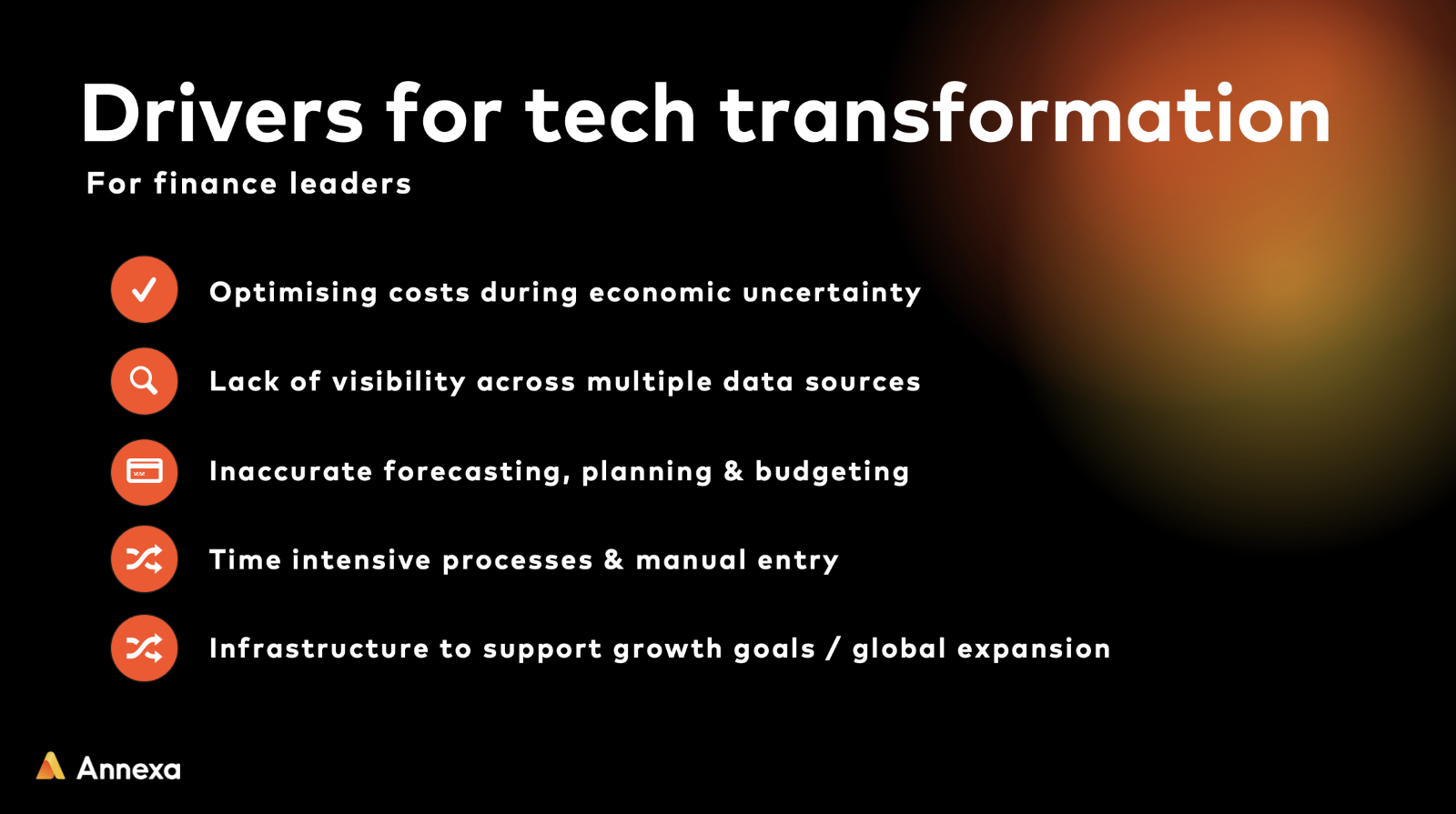

Drivers for tech transformation

There are a number of primary drivers behind the need for technology transformation in financial operations. The rapid pace of technological change, increasing data volumes, competitive pressures, and evolving customer expectations are all necessitating a continuous assessment and strategic upgrade of technology infrastructure.

Technology architecture: how to identify gaps?

Technology gaps have a significant impact on an organisation’s financial visibility and efficiency. Gaps can lead to inefficient processes, data inaccuracies, and hindered decision-making capabilities, ultimately affecting the organisation’s bottom line.

To identify gaps within existing technology architecture, you first need to conduct a thorough analysis of current systems, assessing how well they integrate with each other, their ability to handle current workloads, and their scalability for future growth.

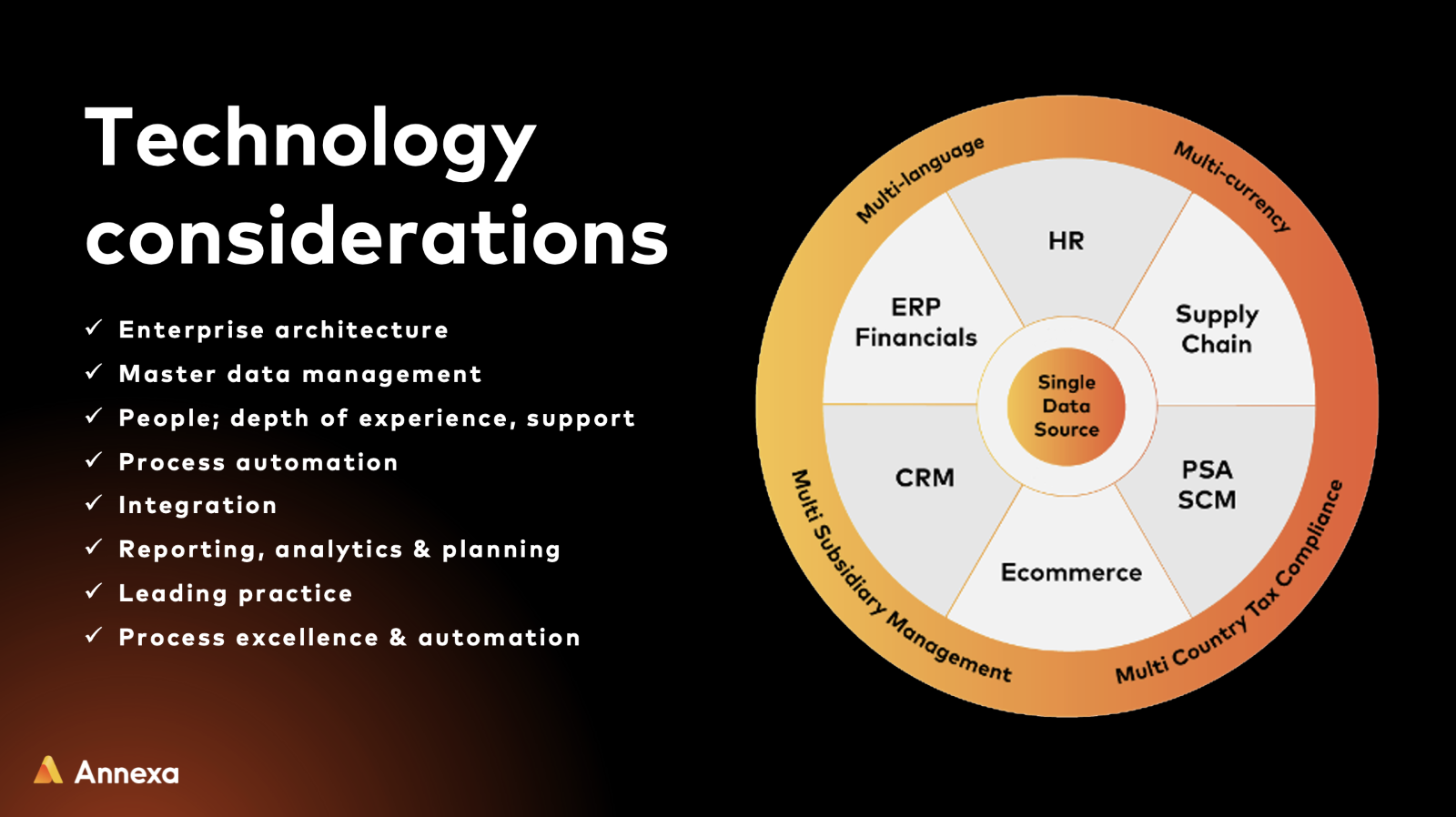

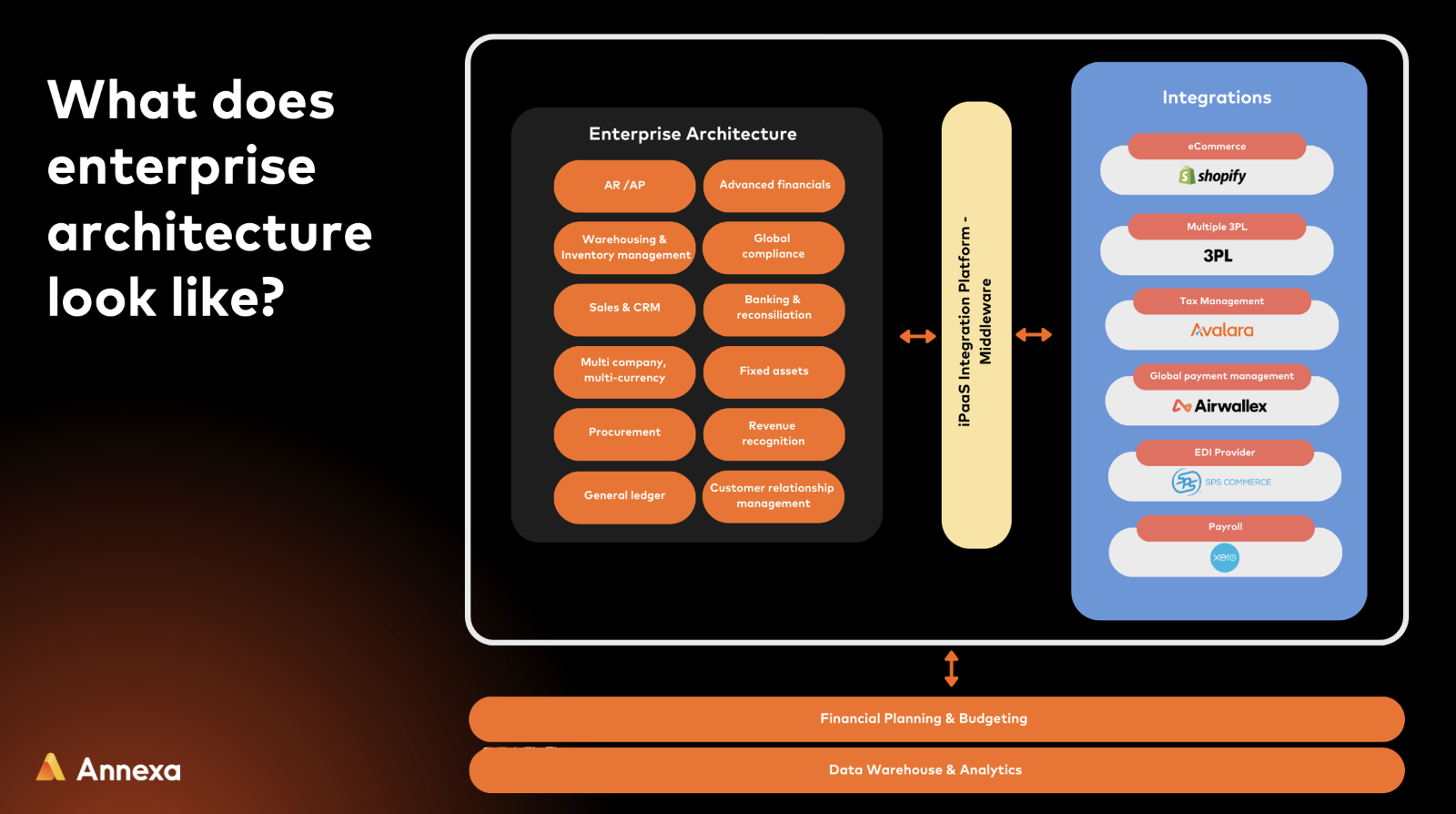

What does enterprise architecture look like?

An effective enterprise architecture (EA) integrates various components of a business’s technology landscape, including software applications, hardware, and network systems. It’s designed to align IT strategy with business goals, ensuring that technology serves as an enabler rather than a constraint.

Process automation for finance

Customer use case: Automated payment gateway reconciliation for a global retail brand

Traditional reconciliation processes, often manual and time-consuming, involve matching ledger entries with bank statements or other financial records. Automation introduces software solutions that can quickly and accurately perform these matches.

Challenge | This customer was facing complexities when reconciling payments due to the use of diverse payment technologies both online and in physical stores.

Solution | To address these challenges, Annexa implemented a holistic cloud-based finance ERP system including various financial operation modules, such as accounts payable, inventory management, and warehouse management.

Results | The automated solution has successfully reconciled over 15 million transactions for 40 different merchants (and counting), showcasing the efficiency and scalability of the automation solution.

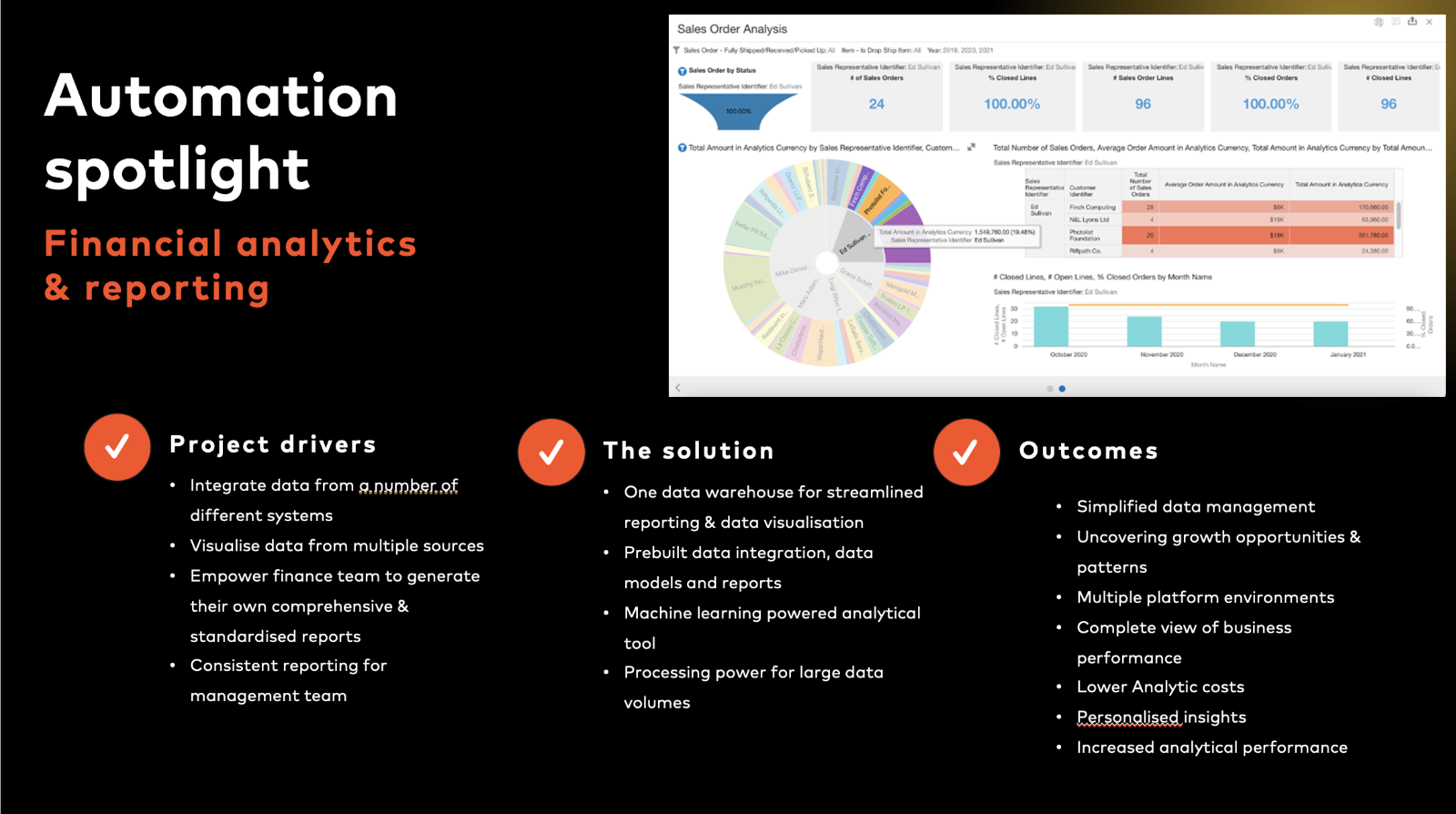

Financial use case: Financial analytics & reporting

The next use case demonstrates the effectiveness of integrating and automating financial reporting systems within an enterprise architecture. This approach simplifies data management but also leverages advanced technologies like machine learning to provide real-time analytics.

Financial challenge | The need for standardised, consistent financial reporting across various business functions, especially in complex enterprise environments with multiple systems and data sources.

Solution | This solution requires an integrated approach where various systems, such as eCommerce platforms and in-store order systems, are connected within an enterprise architecture framework.

Results | Automation leads to more efficient and accurate financial reporting processes, reducing manual efforts and errors while the use of machine learning supports real-time financial insights.

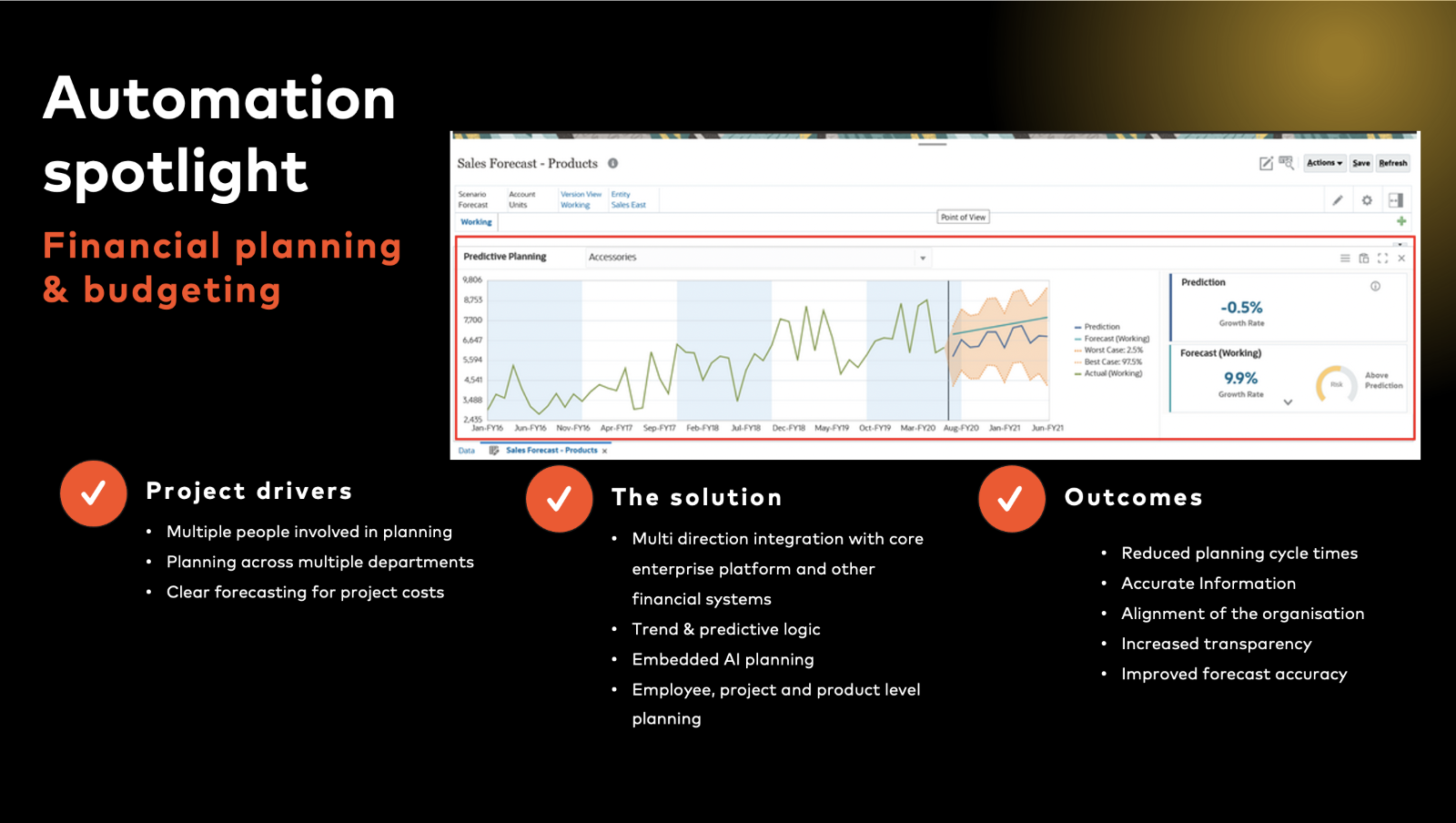

Financial use case: Financial planning & budgeting

In this scenario, we demonstrate how leveraging technology to streamline and automate financial planning and budgeting processes improves efficiency, accuracy, and strategic alignment in its financial operations.

Financial challenge | Disparate systems that rely on a mix of various tools cause process inefficiencies, particularly in areas of forecasting, budgeting, and board reporting.

Solution | Implementing integrated financial planning and budgeting tools allows for the consolidation of data from different platforms. Automation can then be introduced in key areas like cash forecasting and project cost completion.

Results | Automations like these lead to a significant reduction in planning cycle times, better alignment of financial data and reporting, and more cohesive decision-making.

Systems integration for greater visibility

Things get a little more technical when we discuss system integration models and best practices, focusing on how to achieve holistic data management and enhanced decision-making capabilities.

Point-to-point model | A basic integration where each system is directly connected to every other system it needs to communicate with.

Hub-and-spoke model | A more scalable alternative, this model involves a central hub through which all systems communicate.

Integration Platform as a Service (iPaaS) | This is a set of cloud-based integration solutions mostly used for building and deploying integrations in the cloud.

Q&A section

You can watch the full Q&A below to hear insightful questions covering iPaaS tools, generative AI in automating finance-related processes, ROI of automating finance processes, integration challenges, and more.