at a glance

To support the business through high growth, Splitit was ready to introduce automated processes, optimised financial reporting, and improved visibility supported by NetSuite and Annexa.

- Excel

- In-house systems

the client

About Splitit

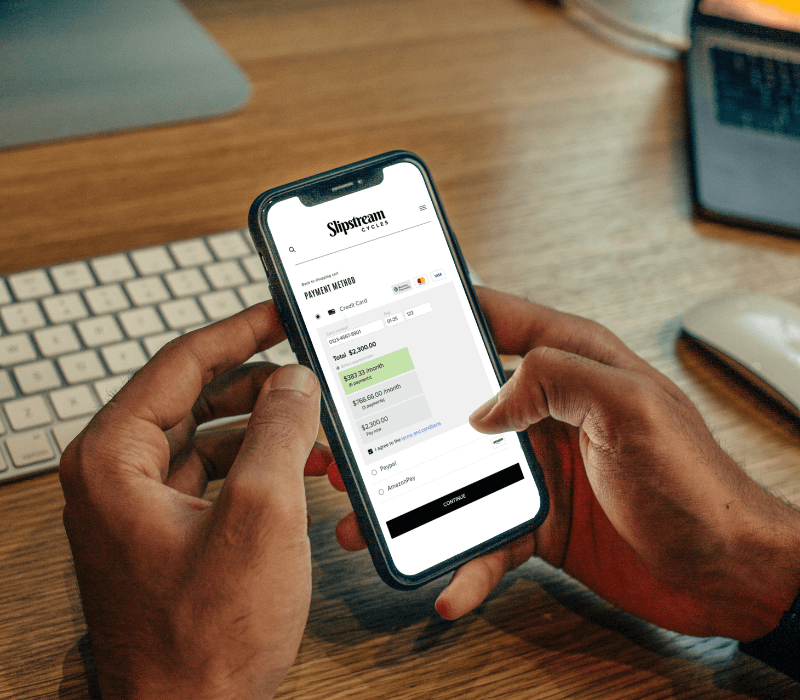

Splitit is a global payment solution provider that serves many of Internet Retailer’s top 500 merchants, with a footprint extending to hundreds of merchants worldwide. Providing a purely B2B whitelabel payments solution, Splitit empowers merchants to offer instalment payments embedded within their customer journey.

Our corporate structure covers several geographies. A lot of our processes were quite manual. At times, controls were lacking and access to data was a challenge as well.Ben MaloneChief Financial Officer, Splitit

the challenge

Splitit’s system roadblocks

The fiercely competitive fintech space requires tech start-ups to have clear visibility into their financial data as they scale and grow on the global stage, and meet stringent compliance requirements along the way.

This was the case for Splitit who was looking to accelerate profitability by expanding into new markets, attracting new merchants and growing Merchant Sales Volume (MSV). To achieve this, they required a robust and comprehensive technology foundation that would provide them with real-time access to accurate and granular financial and operational data. Knowing their existing financial business systems lacked the unity, processes, automation and access to quality data, Splitit selected Annexa to deploy a NetSuite solution to manage its global business functions.

the results

The transformation

The Annexa team and Splitit worked closely on a best-practice NetSuite implementation, leveraging the SuiteSuccess rapid deployment model to deploy NetSuite’s SuiteSuccess Financials First Standard edition. From there, the implementation team built out functionality to consolidate global multi-currency and deliver advanced financial reporting capabilities.

The transition to the NetSuite platform also required careful planning to manage a range of system and application integrations. This included integrating Expensify for expense management, , deploying a new billing system, and linking Salesforce to and from their core NetSuite platform.

It wasn’t just a localised solution either. Splitit operates across six geographies. To consolidate the business across USA, Australia, UK, Canada and Israel, the project introduced global capabilities for managing subsidiaries, multi-currency and tax and regulations, as well as quick access to real-time, global financial reports. Finally, the NetSuite solution laid the groundwork for future integration of billing systems to support the company’s accelerated growth plans.

Today, Split runs operations on its new world-class NetSuite finance platform, driving international expansion and growth while supporting future system integration capabilities.

- Operations spanning 6 geographies

- Salesforce integrations

- Managing multi-subsidiary, multi-currency

- SuiteSuccess deployment model

We manage tens of thousands of individual transactions with a very small team in an environment where we're subject to a lot of audits and scrutiny. So from where we were to where we are now, it's night and day. We have access to accurate data and we can use that information to drive the business forward.Ben MaloneChief Financial Officer, Splitit