Shopify POS began life in 2013 as a lightweight extension of Shopify’s ecommerce platform. It was built for digitally native brands testing physical retail through pop-ups, events and early store concepts, using the same products and customer data they already managed online. The goal was speed and simplicity at the point of sale, not a fully-fledged retail or finance system.

That origin shaped how Shopify POS was adopted for much of the next decade. For retailers running NetSuite, it typically sat at the edge of the stack as a sales channel rather than a system of record. It was useful for transacting in store, but it wasn’t something finance teams relied on for inventory valuation, revenue treatment, tax or multi-entity reporting. NetSuite remained the backbone, with Shopify POS operating firmly downstream.

From 2020, Shopify strengthened its POS to support multi-location retail and higher in-store volumes. What had once suited pop-ups and single stores became viable for growing retail networks, making Shopify POS harder for NetSuite customers to ignore.

What changed wasn’t the role of Shopify POS in finance, but its importance as a source system. As in-store sales volumes grew and operational complexity increased, the quality of integration between Shopify POS and NetSuite became critical. For NetSuite customers evaluating Shopify today, the decision is less about whether Shopify POS can run a store, and more about how cleanly and reliably it feeds the financial core.

What Shopify POS actually is

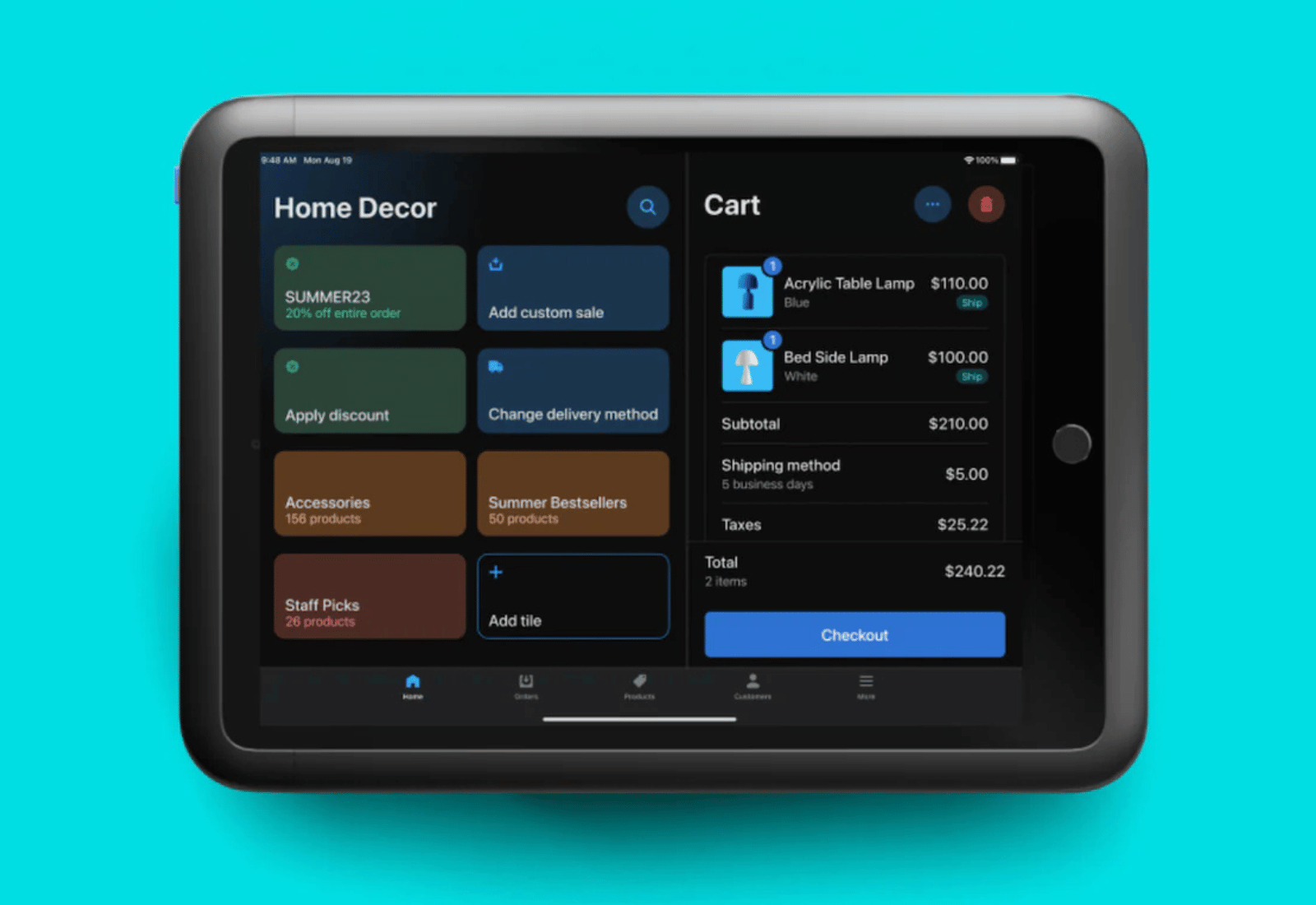

Shopify POS is a cloud-based point-of-sale system designed to run physical retail operations within the broader Shopify platform. It is not a standalone retail system in the traditional sense. It is an extension of Shopify’s commerce model into physical stores.

At its core, Shopify POS handles:

- In-store transactions across card, cash and digital wallets

- Real-time inventory updates shared with online channels

- Basic customer profiles tied to purchase history

- Day-to-day store operations such as staff permissions and register management

The system is configured and managed centrally through Shopify, with stores operating as execution points rather than independent systems. Product data, pricing and inventory logic are typically defined once and applied consistently across channels.

From a systems perspective, Shopify POS sits firmly on the operational side of the stack, capturing and executing retail activity before passing financial outcomes downstream to NetSuite.

Core Shopify POS capabilities

Shopify POS provides a broad set of retail execution features designed to support day-to-day store operations and unified commerce.

- In-store sales and payments – Supports card, cash and digital wallets, with transactions captured in real time at store level.

- Unified inventory management – Inventory updates flow across online and physical channels, helping prevent overselling and stock discrepancies.

- Product and pricing management – Products, variants and pricing are managed centrally in Shopify and applied consistently across stores.

- Customer profiles – In-store purchases can be linked to customer records, supporting basic purchase history and cross-channel visibility.

- Returns and exchanges – Store staff can process returns and exchanges against in-store or online purchases, maintaining a consistent customer experience.

- Gift cards and store credit – Supports issuing and redeeming gift cards across channels, with balances tracked within the Shopify platform.

- Staff roles and permissions – Allows control over who can access registers, issue refunds or perform administrative actions.

- Multi-location support – Enables retailers to operate multiple stores from a single Shopify environment, with shared product and inventory logic.

- Hardware compatibility – Works with a range of supported tills, scanners and payment devices, depending on region and setup.

Taken together, these features make Shopify POS effective at standardising retail execution across growing store networks. For NetSuite-backed retailers, the question is how these operational strengths translate into clean, repeatable financial data downstream.

What Shopify POS is designed to optimise for

Shopify POS is designed to optimise retail execution rather than financial structure. Its priorities are speed, consistency and ease of use at the point of transaction.

In practice, that means:

- Fast deployment across new stores without heavy configuration

- Low training overhead for store staff

- A consistent experience across online and physical channels

- Centralised control over products, pricing and inventory logic

These design choices reflect Shopify’s core assumption that retail activity should flow with minimal friction at the front end, with financial processing handled downstream.

For many fast-scaling retailers, this is a sensible trade-off. Store teams can focus on selling, managers can open new locations quickly and operational complexity is kept out of the shop floor. The implication for finance is structural. Shopify POS captures transactions cleanly and consistently, but it does not organise them in accounting terms. Accounting structure, entity logic, tax treatment and statutory reporting are expected to sit in a system like NetSuite, not inside the POS itself.

Where Shopify POS fits well in NetSuite-backed retail

Shopify POS tends to work best alongside NetSuite when there is a clear separation between retail execution and financial control. This is typically the case in fast-scaling retail businesses where:

- Store networks are growing quickly within a single country

- The brand operates under a simple legal entity structure

- Ecommerce and physical retail are tightly coupled

- Finance teams are comfortable working with summarised transactional data

In these environments, Shopify POS handles the mechanics of selling while NetSuite provides structure around revenue recognition, inventory valuation and reporting. Each system is doing what it was designed to do, with limited overlap.

This setup is particularly effective for digitally native brands expanding into physical retail. Shopify POS allows stores to open quickly without introducing new operational processes, while NetSuite continues to act as the system of record for finance. The key factor is expectation management. Teams that succeed with this combination accept that Shopify POS is not the place where financial nuance is resolved. Instead, they focus on consistency of data capture at the point of sale and rely on NetSuite to impose financial structure downstream.

As long as that boundary is understood and agreed, Shopify POS can support meaningful scale without becoming a bottleneck.

Data flow and integration

For retailers running NetSuite, the challenge of integrating Shopify POS is not unique to Shopify. It reflects a broader reality of how point-of-sale systems generate data versus how finance systems consume it.

POS platforms are designed around transactions as they happen at the till. They prioritise speed, customer experience and operational accuracy. ERP systems are designed around accounting periods, entities, controls and auditability. In practical terms, this means POS data almost always requires transformation before it is suitable for an ERP system:

- Individual sales, returns and exchanges are grouped into summaries that align with accounting periods

- Discounts, promotions and gift cards are normalised so revenue is recognised consistently

- Payment tenders are separated from sales activity to support reconciliation and cash control

- Tax is captured at the point of sale but often restructured for reporting and compliance

These steps exist regardless of whether the POS is Shopify, legacy retail software or a custom system. What changes is the volume of data and the speed at which complexity appears as businesses scale.

This is where experienced NetSuite partners play a practical role, though it is less about technology and more about translation. Experienced NetSuite partners understand how Shopify POS behaviour maps to NetSuite transaction types and where standard connector logic needs to be adapted to reflect the realities of a growing retail operation.

This is why integration effort rarely disappears after go-live. As new stores open, payment methods change or customer behaviour evolves, the way POS data needs to be shaped for NetSuite evolves with it.

Multi-entity and international growth

As retailers expand across entities or geographies, the interaction between Shopify POS and NetSuite becomes more consequential. Shopify POS continues to handle store-level transactions consistently. What changes is the level of financial structure required around that activity. Entity attribution, tax reporting and inventory treatment sit outside the scope of any POS and need to be handled deliberately in NetSuite.

Again, NetSuite partner guidance at this stage is critical to ensure early integration choices continue to work as complexity increases. In practice, this means revisiting entity mapping, aggregation logic and reporting structure as the business grows, without disrupting store operations. Retailers that do this proactively tend to preserve both operational speed and financial control as they scale.

Considering Shopify POS for your eCommerce operations?

For retail leaders evaluating Shopify POS alongside NetSuite, the decision is rarely about functionality alone. It is about whether today’s operational simplicity can be supported by finance structures that will still work as the business grows. Shopify POS can play a central role in that stack, provided its integration with NetSuite is deliberately designed and revisited as the business scales.

If you are currently evaluating Shopify POS for NetSuite, we are more than happy to walk you through your options, reach out to our team here, or contact your Customer Success Manager.