We’re pleased to introduce TRAILD as a new technology partner for Annexa. TRAILD’s AI-powered accounts payable solution is designed to tackle one of finance’s biggest challenges: processing invoices efficiently and securely. As AP automation becomes a clear priority for many of our customers, partnering with TRAILD enables us to bring intelligent AP automation and risk management solutions directly into NetSuite – helping finance leaders modernise sooner and with greater impact.

AP challenges are numerous – extensive data entry, tracking down invoices and approvals, matching invoice line items to POs and managing risks with invoice fraud on the rise. This puts CFOs under pressure to strengthen controls while accurately tracking cash flow and enabling growth.

NetSuite is a powerful ERP platform streamlining finance processes. For NetSuite customers with complex accounts payable needs, embedding AI through the addition of best of breed accounts payable automation tools can be transformative.

TRAILD is a best of breed solution for accounts payable automation that integrates with NetSuite. Unlike other AI-enabled invoice tools that focus only on automating invoice capture and approval workflows, TRAILD leverages AI both for efficiency and to manage risks by reducing errors and preventing fraud.

The result is an intelligent adaptive systems that help finance leaders move from reactive invoice processing to proactive financial control.

3 ways AI for accounts payable transforms finance processes

1. Invoice and payment risk assessment

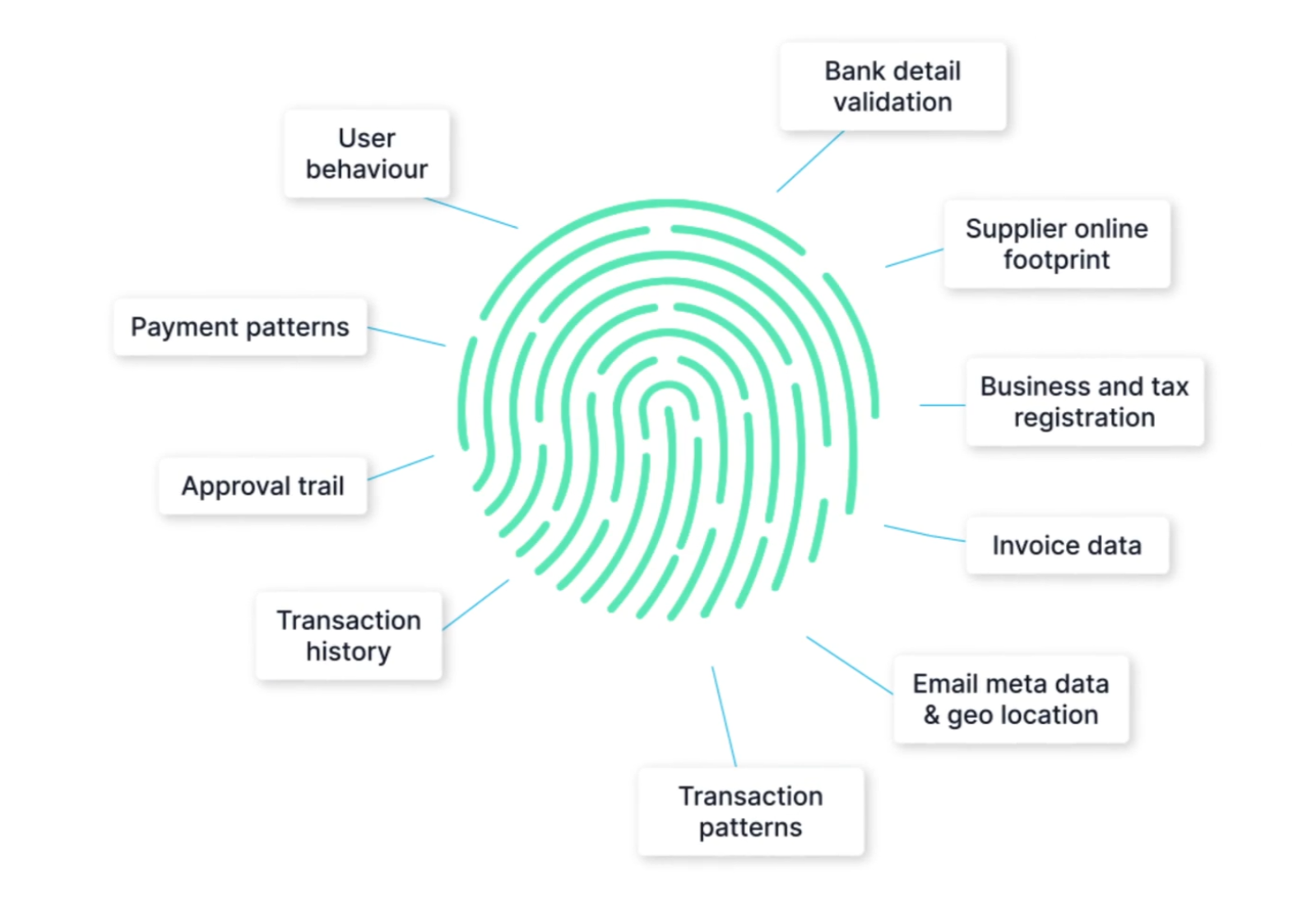

TRAILD leverages AI to create unique fingerprints of both your suppliers and your own business. TRAILD learns what’s “normal” in terms of payment terms, transaction patterns and approval behaviors, so it can instantly detect and flag suspicious activity.

Anomalies such as unusually high invoice values, sequential invoice numbers, changed payment details, or irregular supplier behavior are flagged the moment an invoice is received. Each invoice is assigned a risk score and traffic-light rating – red, amber, green – to surface the highest-risk transactions in real time. This allows teams to act proactively while executives are empowered to focus on only the invoices which need their attention.

2. Invoice capture and coding

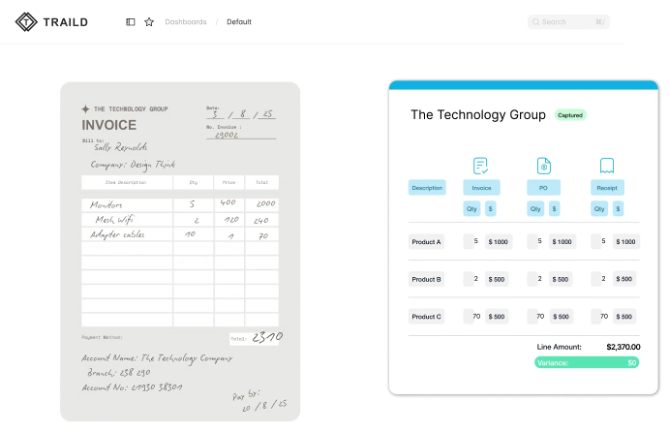

Many traditional AP automation tools rely heavily on optical character recognition (OCR) but OCR alone doesn’t achieve the accuracy that you expect today.

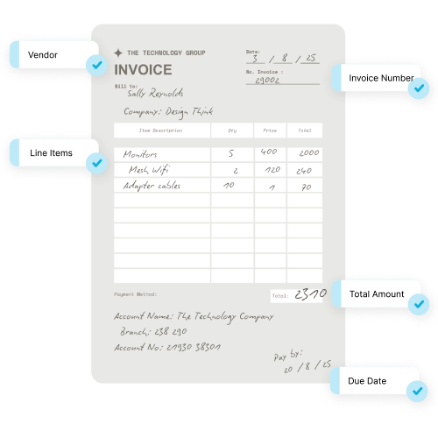

Today’s AI-powered AP solutions like TRAILD combine OCR with natural language processing (NLP) to better interpret and map invoice data, while machine learning ensures the system learns from user corrections so they never have to be repeated.

TRAILD has already processed millions of invoices, so the first time you use it the accuracy of invoice capture and coding is unparalleled. From there, it continuously learns your unique accounts payable environment – your suppliers, coding rules and workflows – so it remembers your corrections and adapts automatically. The result is far greater accuracy with far less manual intervention. Selecting TRAILD for invoice processing with its easy-to-use interface and sophisticated data recognition transforms your accounts payable processes.

3. Invoice approvals

AI in accounts payable is moving beyond automation into prediction, helping finance teams anticipate the next step before it becomes a bottleneck. By learning from historical patterns across suppliers, departments and transactions, predictive AI ensures invoices move seamlessly through the right workflows speeding up cycle times.

TRAILD applies predictive intelligence to instantly suggest who is the most appropriate approver for an invoice. This eliminates guesswork for finance teams, who often waste time chasing down the right approver for new or unfamiliar expenses.

Adding AI tools for AP to NetSuite invoice management is a game-changer for your business

An AI solution for accounts payable like TRAILD is ideal if you’re NetSuite-powered business is:

- Seeking immediate business impact leveraging AI and automation

- Spending significant time on manual data entry and invoice checking

- Growing fast but not wanting to increase headcount

- Needing to be more cost-conscious with pressure on profit margins

- Dealing with unhappy suppliers because it’s taking too long to approve and process payment

- Worried about paying a fraudulent invoice by mistake – or had a near-miss

Leveraging AI in accounts payable not only streamlines processes and saves you time, it embeds fraud protection, reducing risk of fraud and errors for your business.

Ready to leverage AI to reinvent and protect your AP?

If you’re already working with Annexa, your Customer Success Manager can share how TRAILD can optimise AP processes for your business. Or, if you’re new to Annexa, get in touch with our team to explore what TRAILD could do for your business processes.